As the digital currency industry continues to bloom, numerous governments worldwide are joining the crypto-market, with many already holding substantial quantities of Bitcoin. Information from the website Bitfarms.com indicates that as of now approximately nine governments possess an aggregate of $32 Billion in Bitcoin.

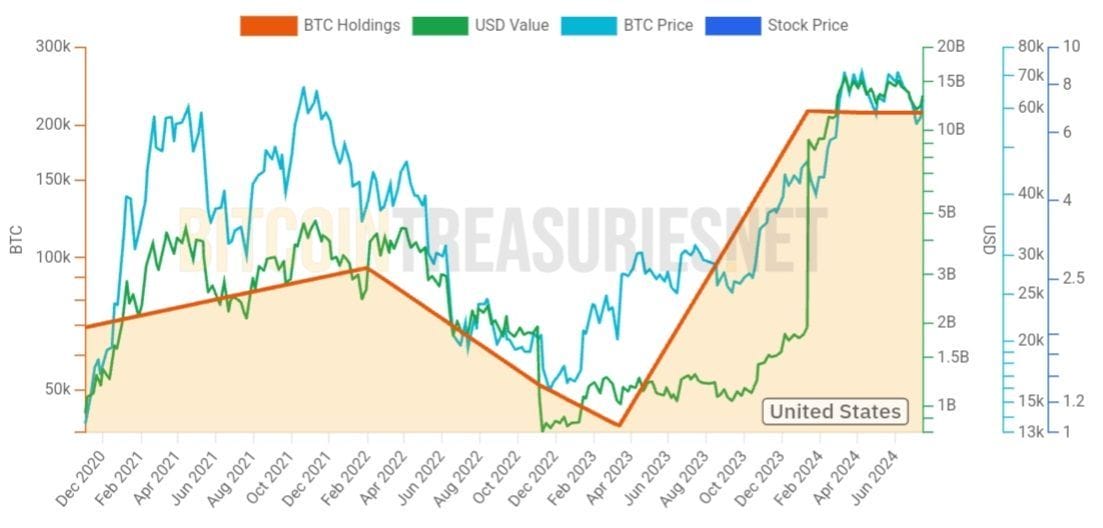

Starting with the United States, it’s interesting to note that the country holds the largest amount of seized Bitcoin in the globe, currently valued at an impressive $6.6 billion. The U.S government primarily obtains these bitcoins via confiscations during criminal investigations. Instead of keeping them, the U.S. government prefers to auction these assets off. As an illustration, in 2014 the U.S. Marshals Service auctioned off 30,000 Bitcoins that had been seized from the notorious online black market, Silk Road.

In Eastern Europe, both Ukraine and Bulgaria also partake in the Bitcoin market. Ukraine, holding Bitcoin worth around $2.6 billion, often uses these assets as a budget filling tool. Bulgaria, on the other hand, is known to hold Bitcoins amounting to at least $2 billion. However, in contrast to Ukraine, Bulgaria has provided little information on what it does with its Bitcoins, making the actions of this government something of an enigma.

Along with the U.S., both China and Russia have a fondness for auctioning off their seized Bitcoins. In China, government authorities – who hold up to $1 billion in Bitcoin – conduct public auctions for the cryptocurrency. Similarly, Russia, with Bitcoin assets worth $90 million, prefers the method of auction to dispose of its Bitcoin assets.

In Northern Europe, both Sweden and Norway feature in the list of Bitcoin-holding governments. Sweden currently deposits its Bitcoin into the treasury while gradually auctioning it off, whereas Norway, through its sovereign wealth fund indirectly invests in Bitcoin by owning shares in MicroStrategy – a company largely investing in Bitcoin.

Venezuela, a South American country, presents an entirely different scenario. Amid economic turmoil and U.S. sanctions, Venezuela has turned to Bitcoin as a means to circumvent these sanctions and facilitate international trade, holding around $482 million in Bitcoin.

Lastly, North Korea, labelled as a rogue state, has allegedly accumulated approximately $700 million in Bitcoin. It has been implicated in numerous cyber-operations to loot and mine Bitcoin, given the digital currency’s potential to offset the economic sting of international sanctions.

In conclusion, the investment and utilization of Bitcoin by governments across the world can serve multiple purposes. From filling budget gaps, investing indirectly via companies, circumventing sanctions, to selling it off through auctions, the advent of digital currency has sure opened new avenues and strategies for governments globally. This trend reflects not only the growing global acceptance of Bitcoin but also highlights the various ways Bitcoin dynamics interact with international finance, law enforcement and diplomatic relations.