Amid the economic turbulence caused by worldwide events and the upcoming US Presidential election, the cryptocurrency markets offer a different facet of the investment arena. The quintessential digital assets, devoid of any physical manifestation but significant in their virtual existence, are carving a niche for themselves in the global economy. As investors diversify their portfolios, this article explores some of the best cryptocurrencies to consider for purchase right now. This information is instrumental for those who are enthused about the appeal of cryptocurrencies or seek to consolidate their existing digital holdings.

Ethereum holds the second position only to Bitcoin in the spectrum of cryptocurrencies. Its unique feature, Ethereum’s blockchain, is hailed for its versatility and application in various domains apart from currency transactions. This blockchain provides a platform for the creation of decentralized applications (DApps). Smart contracts, which eliminate the need for third-party intermediaries, is a key component of Ethereum’s blockchain. Off late, Ethereum has seen a surge in its value, owing to the increased interest in Defi (Decentralized Finance) projects. Experts foresee a promising future for this cryptocurrency, making it a desirable addition to digital portfolios.

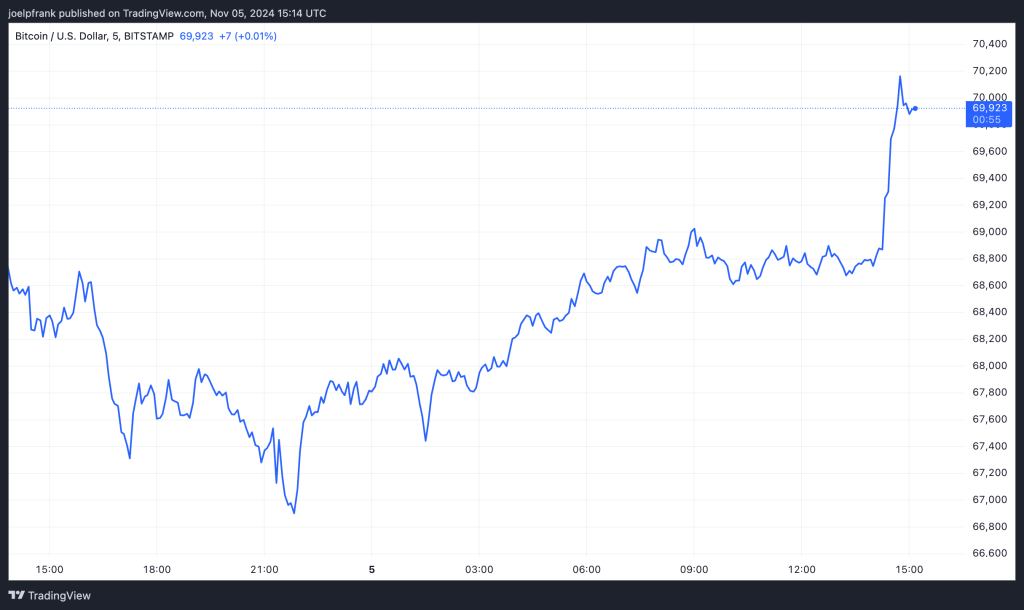

Next on the list is Bitcoin. The palpable buzz around Bitcoin – the pioneer of the cryptocurrency world – is hard to ignore. By many, Bitcoin is regarded as digital gold, with its growth mirroring a store of value. Bitcoin’s value often surges in politically uncertain times or economic recessions as it is seen as a stable reserve that’s not linked to any particular government’s economic policies. Given the upcoming presidential elections in the U.S., seasoned investors and beginners alike could consider Bitcoin as part of a diversified portfolio.

Another name that is making waves in the crypto world is Chainlink (LINK). Chainlink is a decentralized oracle network that acts like a bridge between smart contracts and data outside the blockchain. Its crucial role in feeding external information to the smart contracts has seen its value rise significantly. Furthermore, Chainlink has established partnerships with Google and Oracle— indicating its growing ubiquity and potential to positively impact your investment portfolio.

A unique and still relatively under-the-radar digital asset is Polkadot (DOT), launched by Ethereum co-founder Gavin Wood. The Polkadot platform allows different types of blockchains to communicate and work together in a secure, scalable environment. With its innovative cross-chain transferrable technology and focus on interoperability, it promises enticing opportunities for future growth.

Finally, Litecoin, better known as silver to Bitcoin’s gold, cannot be overlooked. Litecoin has proven itself to be a steady user-friendly digital asset. It has a swifter transaction speed than Bitcoin and lower transaction costs, making it highly utilized for small transactions. The current market appears conducive for accumulating Litecoin to solidify the robustness of your cryptocurrency assets.

Cryptocurrencies offer a distinct space for diversification in an investment portfolio. Nevertheless, they require astute judgment, given their inherent volatility and market sensitivities. It is always wise to delve into thorough research and possibly even consult an investment counselor before taking the plunge. This digital investment, like any other, can significantly impact wealth accumulation strategies, so prudence in purchase decisions is essential.