Article:

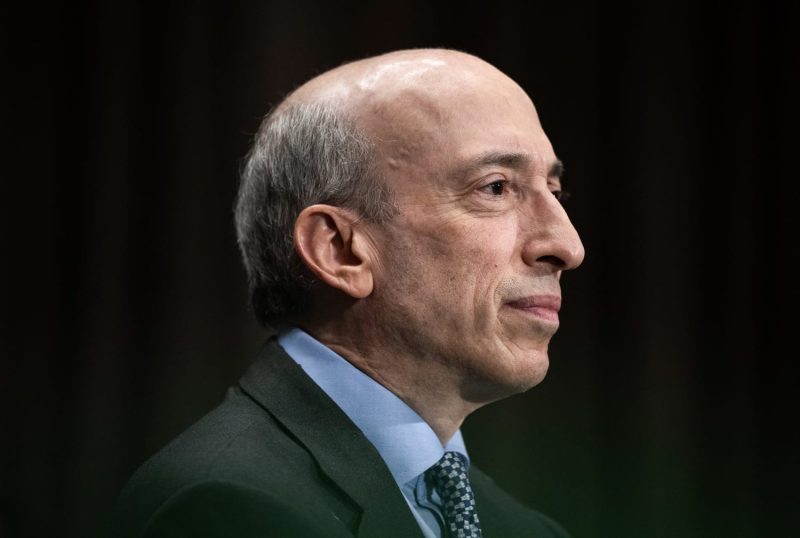

In a significant revelation that has stirred up the stock exchange world, it has been announced that the Chairman of the Securities and Exchange Commission (SEC), Gary Gensler, will vacate his position on January 20. The decision paves the way for a nominee of the Trump administration to take his place, posing significant implications for both the commission and the financial regulation landscape.

After a tenure marked by his firm stance on transparency and investor protection, Gary Gensler’s imminent departure underlines a forthcoming transition in the SEC’s governance. A former Goldman Sachs banker and a professor at MIT, Gensler was widely respected for his in-depth understanding of the financial landscape. His commitment to transparency and regulatory stability were hallmarks of his chairmanship.

However, Gensler’s departure is not without controversy. It has sparked concerns about possible policy shifts under a new leadership selected by the former president Donald Trump. The successor’s appointment could potentially navigate the commission towards a more deregulated ethos, particularly in areas such as environmental, social, and governance (ESG) standards.

Harbingers of this shift are already visible. The Trump administration has on multiple occasions espoused a preference for less oversight in financial markets. Indications are that the new chairman could potentially pull back on Gensler’s rigorous regulations, shifting the SEC’s direction significantly.

Moreover, it’s crucial to note that the chairman’s departure comes at a pivotal juncture, amid ongoing debates about the role of the SEC and its potential to shape financial regulations. In recent years, calls have grown louder for the SEC to take more significant measures in controlling systemic risk, enhancing market transparency, and preventing financial fraud.

Amid these debates, Gensler’s departure might signal a period of uncertainty for the SEC. However, it is essential to note that the SEC, as a regulatory body, has historically demonstrated its capacity to adapt to changes in its leadership. For decades, it has effectively grappled with the dynamism of the global financial industry and maintained the robustness of United States’ capital markets.

In summary, Gensler’s departure embeds implications that extend far beyond the SEC. From investors to financial institutions, all stakeholders in the financial markets must brace for new policies and direction under a Trump-selected chairman.

The changing of guard at the SEC thus raises several questions. Will the incoming chairman favor a more laissez-faire approach to market regulation? Or will they adhere to the path that Gensler charted? As of now, these questions remain pending, offering an intriguing narrative on the future of SEC and financial regulation.

As financial markets continue to evolve, the decisions taken in the corridors of the SEC will play a significant role in shaping the future of global finance. Anyone invested in the future of the stock markets and financial regulations, undoubtedly hopes for a leader who can effectively navigate the continually shifting landscape of the financial world while ensuring integrity, protection, and prosperity for all stakeholders involved.