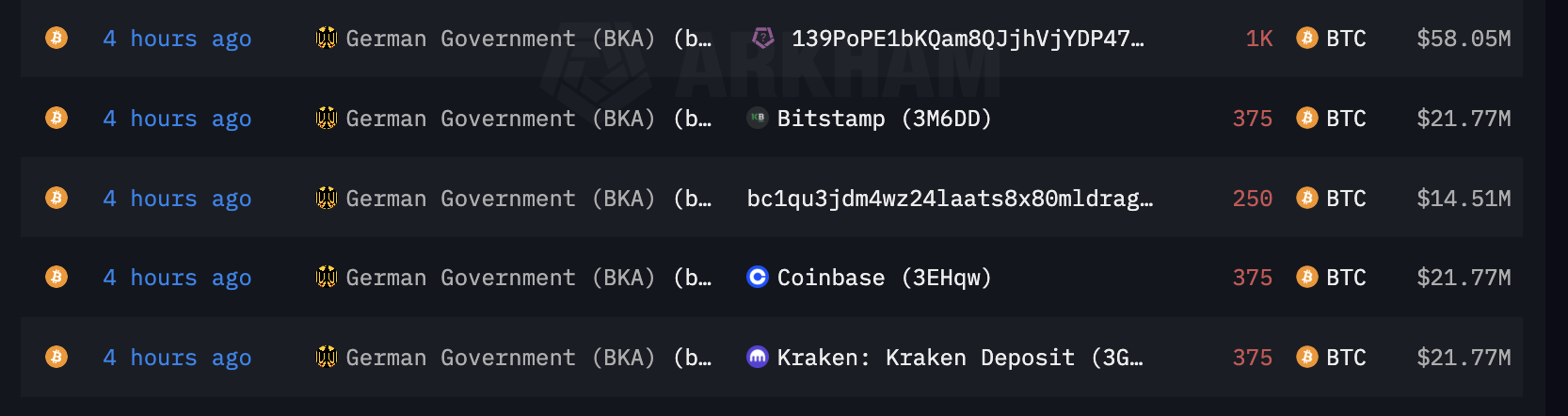

In a significant move, the German government has shifted another lot of Bitcoin, estimated to be around 1125 BTC, to majorly recognized cryptocurrency exchanges – Coinbase, Kraken, and Bitstamp. Established cryptocurrency market followers are keenly observing this intriguing development.

The mentioned quantity of BTCs, currently valued roughly at thousands of dollars, was moved on July 20 according to blockchain data. This sum was divided among three exchanges, with Coinbase receiving 441 BTC, Kraken 315 BTC, and Bitstamp 369 BTC. However, the precise reason or reasons behind these transfers are yet to be confirmed.

The German government has been known to seize considerable amounts of Bitcoins during their numerous efforts in tackling illicit online activities. Often number of these Bitcoins are sold off in auctions. Several government-led bitcoin auctions have pulled in substantial sums in the past, earning the government millions derived from the sale of confiscated bitcoins.

Principally, governments selling off confiscated bitcoins – though not necessarily prevented – is not encouraged either. Blockchain investigation platform Chainalysis in 2020 spurred a debate, questioning the effects multiple bitcoin sales by US authorities had on the market. The concern revolves around how these transactions could theoretically lead to increased volatility in the bitcoin market, hence it is not a preferred route.

Moving on to exchanges, Coinbase, Kraken, and Bitstamp, these are amply recognized and highly trusted entities in the crypto domain. Coinbase, holds a reputation for serving as an accessible yet secure platform for anyone interested to trade cryptocurrencies. On the other hand, Kraken is renowned for offering comprehensive features, stringent security measures, and noteworthy customer support. Bitstamp stands out for its array of digital currencies available for buying, selling, and trading, along with prime securities, listing it among the top global exchanges.

The German government’s movement of the seized bitcoins to these eminently well-regarded exchange platforms signals its trust in these entities. This trust plays a crucial role in enhancing these platforms’ credibility, which in return, paves the way for escalating the widespread adoption of cryptocurrencies.

Noteworthy here, is also the German government’s decision to diversify its holdings among three exchanges as against a single one. This decision emphasizes the German government’s acknowledgement of the risks involved in handling sizeable cryptocurrency sums and hence expands its chances to prevent any one point failure system, enhancing overall security.

In conclusion, this move by the German government could further validate crypto exchanges and the use of cryptocurrencies, potentially leading to increased trust and wider acceptance of digital currencies in the general public.